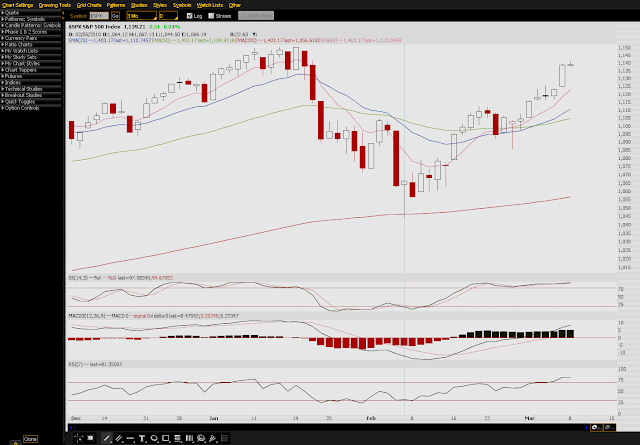

Last week the market reacted positive to the jobs report to end the week on the highs near 1138 on the SPX. The action impressed me as I had been thinking all week we were going to retrace if not rollover but the sentiment out there continued to be overly pessimistic and in the short term that's all the market needed for fuel to edge higher. With the market this close to the Jan highs I would think they get tested this week or that would be too easy maybe? It is definitely not the time to be starting long positions and I think we are very likely to get some sort of pullback this week as there are several gaps down below here, namely the one near 1105. All gaps get filled on the ES. Of course the momentum may still remain to the upside but I just doubt we make to new highs without some sort of double top at first and then consolidation. Markets usually don't usually don't break out right after running for 4 weeks straight.

Another interesting thing about the 2010 price action I noticed is that the correction in late Jan took only 13 days while the move back up we have seen so far has been 20 days. We are nearing twice the "TIME" it took to correct and we still have not tested or broken the 2010 highs. When it comes to time cycle analysis it is usually is saying that the the trend that takes twice as long is the struggling trend. Nevertheless the market has held in there so it should be interesting to see how it acts in the next few weeks going into March option expy.

Econ data this week is light with the highlights being at the end of the week with usual jobless claims and business inventories. There will also be a few treasury auctions this week for 3-yr, 10-yr, and 30-yr notes.

Currencies- The Euro has been consolidating in a sideways pattern between 1.345 and 1.37. It does look like it could make an attempt to pop up out of the channel and test as high as the 50 day ema near 1.39 but the odds are that the trend down will resume and make new lows in the near future. The dollar index has looked a bit tired lately and is always just the opposite of the Euro. When I look at the dollar I see more of a bull flag consolidation rather than a topping pattern. For that reason I tend to think the dollar heads higher and could see 82 soon. The GBP/USD is still weak and rallies should be sold in this pair. The commodity currencies including the AUD/USD have been strong lately but look to be losing some momo this week and that could be an early sign to watch for a pullback in the energy and metals futures. Especially if the Aussie breaks below the 0.90 level.

Commodities- Oil has held up strong and could either be at the top of the long term channel we have seen or it could be getting ready to breakout of the low 80s and head towards 90. I kinda doubt it will break out right now but I have been wrong on oil lately so go figure. Copper does continue to look toppy to me and 3.45-3.50 is monster long term resistance. Gold had a nice week last week and could go higher as long as it holds 1120. I tend to think gold will be in a sideways pattern for the next several months. Finally, the grains had a ugly week and it looks like wheat, beans, and even corn are headed lower as the charts in these names look very vulnerable.

Buy the dips>> RIMM, RYL, V, AKAM, MGM

Sell the rips>> FCX, RL, RIG, WFR, DSX

No comments:

Post a Comment