This week is a shortened week as Friday is Good Friday and the market is closed. However, they will still release the jobs report that morning and I believe the futures market will be open for at least a few hours. It should be interesting to see how the market reacts having a few extra days to really digest the data. Otherwise this week is the end of the 1st quarter and early on we are likely to see some "window-dressing".

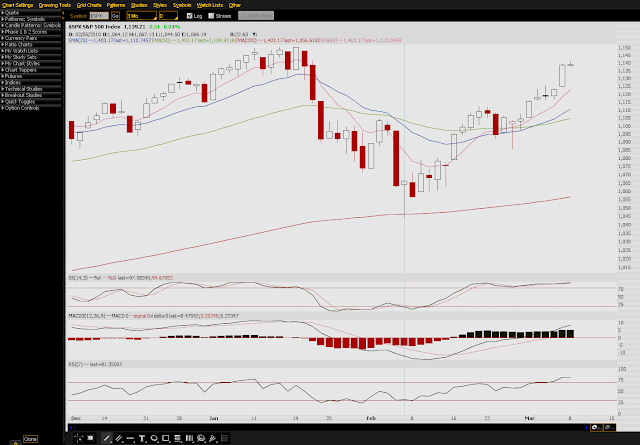

The SPX pulled back to the 8ema last week and seems to want to bounce off of it. Short term I think we can tag 1185 this week. We really have no choice but to be cautiously bullish above the 1150 level. Another thing to watch for will be whether the pullbacks last less than 4 days. So far they have. Those are normal pullbacks within a bull trend. I would not be surprised to see the jobs report mark some kind of an important short term to interim top going into April so be warned.

Currencies- The Euro bounced back a bit this morning to 1.35 and the GBP is back to 1.50. It still looks like this is a weak bounce within a bearish downtrend. I like the dollar and think the DXY is still headed higher after it reached my initial target of 82.50 last week. USD/JPY rallied hard last week reaching almost 93. The pair has based out for 6 months or more now and I think from looking at the weekly chart that we could have seen a major top on the yen and look for the dollar to appreciate towards 100/yen in the coming months. Aussie and CAD remain strong after pausing for a little bit to consolidate. Obey the trend there.

Commodities- Oil is still fighting the 82-83 level and I have really dont know what it wants to do. Either close above 84 to be bullish or under 79 to be bearish. Copper looks more bullish after just flagging out last week and now is challenging the 3.50 level which could very well signal a breakout to the upside. Gold and silver look strong once again as they just bounce around in these ranges lately. Until gold closes above 1140 I expect more rangebound trading.

Bonds- Interesting action in bonds last week. The 10 and 30 year sold off sharply and yields on the 10 year approached 3.9%. Any close above the 3.9 level signals a major long term shift in the bond market. I believe we are seeing the top in bond prices for the next decade if not longer. Yields will rise towards 7% in the coming years as more investors demand a higher return for the risk of holding our debt. This is my long term thought on the bonds and the way to play will be puts on TLT or calls on TBT if you cannot trade the futures. Short term the TLT is bouncing back a bit but any strength is made to sell.

Buy the dips>> TBT, BIDU, MGM, RF, NOG, FLR

Sell the rips>> CHL, LM, KALU

Monday, March 29, 2010

Monday, March 22, 2010

Weekly Outlook 3/22

Yes we are in a bull market. Yes I think the bull market is probably in the 7th inning stretch of its move and I doubt it gets to extra innings. Yes, the final stages of a bull market can be the most rewarding and fast moving. No its not a good idea to try to short it thinking you caught the top. Believe me I've learned. Anywho, as for this week we have Obama-care passed and stocks gapped down sunday night only to recover and turn green monday morning. I do think the markets are overextended wherever you look and this should produce a minor pullback this week. It would be surprising to me if we do not at least stall out and consolidate.

A pullback to the 1150 area is buyable as that was previous resistance and now is support. Below that level we should see 1120s possible and then if the market gets below that the 1105 gap fill is highly likely. However, if we rally up and make new highs look for 1185 to be first resistance and then ultimately 1200. Unless, we sell for greater than 3-4 days then this should just be a pullback within a bull trend. Don't fight it. I think this market is strong enough to rally up into early April believe it or not. There is still simply not enough bulls out on the street to signal a major top.

Economic data is light this week with the important stuff being new home sales Wed. and claims on Thurs. Bernanke speaks before Congress on Thursday as well.

Currencies- This is where the volatility has been for sure. The euro and pound are normally more volatile than the stock indices but lately have really been moving. Friday the GBP lost about 250 pips. This week I expect the weakness in these currencies to continue The 1.35 level in the EUR is very important and if it breaks I expect the 1.3250 mark to be seen. The GBP should continue lower to 1.45 in the interim but could see some choppy backing and filling action on its way there. The dollar index looks strong and ready to break higher thru 81. I think 82.50 is a good short term target in the /DX for the next leg higher. Commodity currencies like the AUD have stayed strong recently as the Aussie hit .925 last week and now is pulling back a bit. The pair still looks strong so I would guess it consolidates further.

Commodities- Copper and oil have stayed remarkably strong during the recent months of dollar strength and are still hanging out at the top end of their ranges. Something tells me a correction is needed in this space but what do the charts say? Oil looks strong above the 79 level which is the site of the 50 day ema. I am not sold on oil moving higher until a close above 84. If we break 79 I think we see a quick retracement into the 74s. Copper is similiar on the daily but appears to be forming a bull flag so if this doesn't break down under 3.28 then it could remain strong and challenge the highs of 3.50. Gold is the tricky one and its because it looks like it wants to go higher but then sells off. That's a very choppy chart when I look at it and I think gold can remain rangebound between 1080-1140 for awhile. This is generally the quiet time of year for gold and precious metals anyway.

Buy the dips>> WYNN, TGT, PAG, DNDN, NTRS, VMC

Sell the rips>> JRCC, STT, SCCO, PBR

A pullback to the 1150 area is buyable as that was previous resistance and now is support. Below that level we should see 1120s possible and then if the market gets below that the 1105 gap fill is highly likely. However, if we rally up and make new highs look for 1185 to be first resistance and then ultimately 1200. Unless, we sell for greater than 3-4 days then this should just be a pullback within a bull trend. Don't fight it. I think this market is strong enough to rally up into early April believe it or not. There is still simply not enough bulls out on the street to signal a major top.

Economic data is light this week with the important stuff being new home sales Wed. and claims on Thurs. Bernanke speaks before Congress on Thursday as well.

Currencies- This is where the volatility has been for sure. The euro and pound are normally more volatile than the stock indices but lately have really been moving. Friday the GBP lost about 250 pips. This week I expect the weakness in these currencies to continue The 1.35 level in the EUR is very important and if it breaks I expect the 1.3250 mark to be seen. The GBP should continue lower to 1.45 in the interim but could see some choppy backing and filling action on its way there. The dollar index looks strong and ready to break higher thru 81. I think 82.50 is a good short term target in the /DX for the next leg higher. Commodity currencies like the AUD have stayed strong recently as the Aussie hit .925 last week and now is pulling back a bit. The pair still looks strong so I would guess it consolidates further.

Commodities- Copper and oil have stayed remarkably strong during the recent months of dollar strength and are still hanging out at the top end of their ranges. Something tells me a correction is needed in this space but what do the charts say? Oil looks strong above the 79 level which is the site of the 50 day ema. I am not sold on oil moving higher until a close above 84. If we break 79 I think we see a quick retracement into the 74s. Copper is similiar on the daily but appears to be forming a bull flag so if this doesn't break down under 3.28 then it could remain strong and challenge the highs of 3.50. Gold is the tricky one and its because it looks like it wants to go higher but then sells off. That's a very choppy chart when I look at it and I think gold can remain rangebound between 1080-1140 for awhile. This is generally the quiet time of year for gold and precious metals anyway.

Buy the dips>> WYNN, TGT, PAG, DNDN, NTRS, VMC

Sell the rips>> JRCC, STT, SCCO, PBR

Monday, March 15, 2010

Weekly Outlook 3/15

The market had a pretty flat week as it got up to the 1150 resistance and looked like it struggled a bit on Friday as it opened at the highs and sold off. This week we should see a pullback off this obvious resistance and it could get back to 1120-1125. This is a very tricky market at this point because we are up almost 2 weeks in a row with out any interruption. That is very rare. You gotta think the rubber band is stretched too far. While I do think this could be a significant interim top going into the spring I can still see this market pushing up thru 1150 for another leg higher. But for the next few weeks I anticipate a pullback consolidation at the very least. If we lose 1120ish then the selling should intensify. There are still unfilled gaps in the ES down below at 1105ish.

This week we have some catalysts that could pick up the volatility. Fed day is tuesday and that is sure to get the markets moving. In the past fed days have marked tops and bottoms and I wouldn't be surprised to see the same short term reaction. Quad witching option expiration week is also here and that adds to market volatility as well. I think this is a very important week to watch transpire. For swing traders it makes sense to lighten up or sell longs up here and wait for a pullback to come and see if it holds.

Sentiment has picked up to the bullish side now as the AAII weekly survey showed 45% bulls, up from just 35% a week ago. Historically this is getting up into an overly optimistic level. Not extreme yet by any means but it could point to the recent rally being long in the tooth and overdone as these numbers are meant to be interpreted on a contrarian mindset.

Currencies- EUR/USD popped a bit on friday as stops got ran above the 1.37 level. It moved to nearly 1.38 overnight which is a 100 pip move. This week I think the euro can tag higher levels perhaps into the 1.39-1.40 area if it sustains some buying pressure above that recent consolidation. GBP/USD is forming a similar pattern to the euro just sitting between 1.49-1.52. Look for the top of this range to fail early this week and consolidate lower. USD/JPY is ready to make a move off the 90.5 level. If the recent trend continues you could see 92 in this pair this week. The commodity currencies look overdone to the upside as the Aussie challenged 0.92 friday and the USD/CAD made new lows last week near 1.0150. The move in the candadian dollar has been impressive but could use a breather this week. Does this mean commodities are showing a sell signal?

Commodities- Crude oil has put in a nice double top off the 83 level as it reversed hard on friday and closed lower. This morning it is already 2% lower and looks like it may bring the rest of the commodities lower as well. Interesting thing here is to see if it just the standard 2-4 day pullback or something more. It does seem to me like we could see oil test 78 and if it breaks that then the low 70s will be back. The metals also look a bit heavy and copper is double topping here too. Same thing applied to copper as oil. Gold is holding 1100 barely and looks like it might lose it this week. Below that level and you might see gold retest the 1060s perhaps.

Buy the dips>> GE, CIEN, MCD

Sell the rips>> BTU, RIG, BBL, HBC, KLAC

This week we have some catalysts that could pick up the volatility. Fed day is tuesday and that is sure to get the markets moving. In the past fed days have marked tops and bottoms and I wouldn't be surprised to see the same short term reaction. Quad witching option expiration week is also here and that adds to market volatility as well. I think this is a very important week to watch transpire. For swing traders it makes sense to lighten up or sell longs up here and wait for a pullback to come and see if it holds.

Sentiment has picked up to the bullish side now as the AAII weekly survey showed 45% bulls, up from just 35% a week ago. Historically this is getting up into an overly optimistic level. Not extreme yet by any means but it could point to the recent rally being long in the tooth and overdone as these numbers are meant to be interpreted on a contrarian mindset.

Currencies- EUR/USD popped a bit on friday as stops got ran above the 1.37 level. It moved to nearly 1.38 overnight which is a 100 pip move. This week I think the euro can tag higher levels perhaps into the 1.39-1.40 area if it sustains some buying pressure above that recent consolidation. GBP/USD is forming a similar pattern to the euro just sitting between 1.49-1.52. Look for the top of this range to fail early this week and consolidate lower. USD/JPY is ready to make a move off the 90.5 level. If the recent trend continues you could see 92 in this pair this week. The commodity currencies look overdone to the upside as the Aussie challenged 0.92 friday and the USD/CAD made new lows last week near 1.0150. The move in the candadian dollar has been impressive but could use a breather this week. Does this mean commodities are showing a sell signal?

Commodities- Crude oil has put in a nice double top off the 83 level as it reversed hard on friday and closed lower. This morning it is already 2% lower and looks like it may bring the rest of the commodities lower as well. Interesting thing here is to see if it just the standard 2-4 day pullback or something more. It does seem to me like we could see oil test 78 and if it breaks that then the low 70s will be back. The metals also look a bit heavy and copper is double topping here too. Same thing applied to copper as oil. Gold is holding 1100 barely and looks like it might lose it this week. Below that level and you might see gold retest the 1060s perhaps.

Buy the dips>> GE, CIEN, MCD

Sell the rips>> BTU, RIG, BBL, HBC, KLAC

Monday, March 8, 2010

Weekly Outlook 3/8

Last week the market reacted positive to the jobs report to end the week on the highs near 1138 on the SPX. The action impressed me as I had been thinking all week we were going to retrace if not rollover but the sentiment out there continued to be overly pessimistic and in the short term that's all the market needed for fuel to edge higher. With the market this close to the Jan highs I would think they get tested this week or that would be too easy maybe? It is definitely not the time to be starting long positions and I think we are very likely to get some sort of pullback this week as there are several gaps down below here, namely the one near 1105. All gaps get filled on the ES. Of course the momentum may still remain to the upside but I just doubt we make to new highs without some sort of double top at first and then consolidation. Markets usually don't usually don't break out right after running for 4 weeks straight.

Another interesting thing about the 2010 price action I noticed is that the correction in late Jan took only 13 days while the move back up we have seen so far has been 20 days. We are nearing twice the "TIME" it took to correct and we still have not tested or broken the 2010 highs. When it comes to time cycle analysis it is usually is saying that the the trend that takes twice as long is the struggling trend. Nevertheless the market has held in there so it should be interesting to see how it acts in the next few weeks going into March option expy.

Econ data this week is light with the highlights being at the end of the week with usual jobless claims and business inventories. There will also be a few treasury auctions this week for 3-yr, 10-yr, and 30-yr notes.

Currencies- The Euro has been consolidating in a sideways pattern between 1.345 and 1.37. It does look like it could make an attempt to pop up out of the channel and test as high as the 50 day ema near 1.39 but the odds are that the trend down will resume and make new lows in the near future. The dollar index has looked a bit tired lately and is always just the opposite of the Euro. When I look at the dollar I see more of a bull flag consolidation rather than a topping pattern. For that reason I tend to think the dollar heads higher and could see 82 soon. The GBP/USD is still weak and rallies should be sold in this pair. The commodity currencies including the AUD/USD have been strong lately but look to be losing some momo this week and that could be an early sign to watch for a pullback in the energy and metals futures. Especially if the Aussie breaks below the 0.90 level.

Commodities- Oil has held up strong and could either be at the top of the long term channel we have seen or it could be getting ready to breakout of the low 80s and head towards 90. I kinda doubt it will break out right now but I have been wrong on oil lately so go figure. Copper does continue to look toppy to me and 3.45-3.50 is monster long term resistance. Gold had a nice week last week and could go higher as long as it holds 1120. I tend to think gold will be in a sideways pattern for the next several months. Finally, the grains had a ugly week and it looks like wheat, beans, and even corn are headed lower as the charts in these names look very vulnerable.

Buy the dips>> RIMM, RYL, V, AKAM, MGM

Sell the rips>> FCX, RL, RIG, WFR, DSX

Another interesting thing about the 2010 price action I noticed is that the correction in late Jan took only 13 days while the move back up we have seen so far has been 20 days. We are nearing twice the "TIME" it took to correct and we still have not tested or broken the 2010 highs. When it comes to time cycle analysis it is usually is saying that the the trend that takes twice as long is the struggling trend. Nevertheless the market has held in there so it should be interesting to see how it acts in the next few weeks going into March option expy.

Econ data this week is light with the highlights being at the end of the week with usual jobless claims and business inventories. There will also be a few treasury auctions this week for 3-yr, 10-yr, and 30-yr notes.

Currencies- The Euro has been consolidating in a sideways pattern between 1.345 and 1.37. It does look like it could make an attempt to pop up out of the channel and test as high as the 50 day ema near 1.39 but the odds are that the trend down will resume and make new lows in the near future. The dollar index has looked a bit tired lately and is always just the opposite of the Euro. When I look at the dollar I see more of a bull flag consolidation rather than a topping pattern. For that reason I tend to think the dollar heads higher and could see 82 soon. The GBP/USD is still weak and rallies should be sold in this pair. The commodity currencies including the AUD/USD have been strong lately but look to be losing some momo this week and that could be an early sign to watch for a pullback in the energy and metals futures. Especially if the Aussie breaks below the 0.90 level.

Commodities- Oil has held up strong and could either be at the top of the long term channel we have seen or it could be getting ready to breakout of the low 80s and head towards 90. I kinda doubt it will break out right now but I have been wrong on oil lately so go figure. Copper does continue to look toppy to me and 3.45-3.50 is monster long term resistance. Gold had a nice week last week and could go higher as long as it holds 1120. I tend to think gold will be in a sideways pattern for the next several months. Finally, the grains had a ugly week and it looks like wheat, beans, and even corn are headed lower as the charts in these names look very vulnerable.

Buy the dips>> RIMM, RYL, V, AKAM, MGM

Sell the rips>> FCX, RL, RIG, WFR, DSX

Monday, March 1, 2010

Weekly Outlook 3/1

The first week of March is here and historically the markets see important lows made in the month of March. Will we retrace down to make that sort of low? That is the question. I still believe you should be cautious as there is very little upside potential imo. Banks have still been weak and even this morning are mixed or even selling off on a strong gap up. I think any sustainable rally needs the financials to be participating. The technicals do look very confusing on the major indices as I was checking out the charts yesterday. The larger formations in the Nasdaq and SPX are showing some head and shoulder patterns while the short term move has the potential to pop out of a bull flag and test the 1120 area, which remains very heavy resistance.

Data will drive the price action this week as we have manufacturing stats coming out as well as the all important jobs report on Friday. Fed Beige Book is due out Wednesday and several central banks have interest rate decisions including the ECB, BoE, and BoC which will make it an active week for those respective currencies around the globe.

Currencies- The dollar looks like it still wants to push higher a bit more as the Euro just simply can't get anything going. There is alot more consensus building that the Euro is going to parity with the dollar in the long term and you know that consensus thinking is never something you want to be a part of unless you are in high school. The Euro has good support at the 1.35 level but if that breaks we should see 1.3250 fairly quickly. The GBP is getting whacked sunday night into monday and could be a leading indicator for the EUR going forward.

Commodities- Crude looks to test the 80 level again early this week but will it fail again? The more a level is tested the higher the odds are that it is broken. But oil still looks awfully toppy to me up here and I would expect a rejection at 80 again and a return to the mid to low 70s in the coming week or two. Copper gapped up 6% on sunday night after the Chile earthquake but is giving up much of its gains this morning as I type. Copper is definitely overextended up here and stocks like FCX have not came back as aggressively as the commodity itself and so that tells me to be cautious. Gold also is interesting because above 1120 or so it looks bullish technically speaking but a close under 1090 and its a clear sell signal.

Overall this week I am feeling very mixed on the indices as some are looking toppy and some are still showing some resiliency. I do think we should see a sharp move with conviction by the end of this week and that move should guide us for the next few weeks on a directional bias. I am leaning lower as long as we cannot clear the 1120s on the SPX.

Buy the dips>> RIMM, BIDU, EK, EOG, EAT, INCY

Sell the rips>> FCX, GOOG, HES, PDE, GS

Data will drive the price action this week as we have manufacturing stats coming out as well as the all important jobs report on Friday. Fed Beige Book is due out Wednesday and several central banks have interest rate decisions including the ECB, BoE, and BoC which will make it an active week for those respective currencies around the globe.

Currencies- The dollar looks like it still wants to push higher a bit more as the Euro just simply can't get anything going. There is alot more consensus building that the Euro is going to parity with the dollar in the long term and you know that consensus thinking is never something you want to be a part of unless you are in high school. The Euro has good support at the 1.35 level but if that breaks we should see 1.3250 fairly quickly. The GBP is getting whacked sunday night into monday and could be a leading indicator for the EUR going forward.

Commodities- Crude looks to test the 80 level again early this week but will it fail again? The more a level is tested the higher the odds are that it is broken. But oil still looks awfully toppy to me up here and I would expect a rejection at 80 again and a return to the mid to low 70s in the coming week or two. Copper gapped up 6% on sunday night after the Chile earthquake but is giving up much of its gains this morning as I type. Copper is definitely overextended up here and stocks like FCX have not came back as aggressively as the commodity itself and so that tells me to be cautious. Gold also is interesting because above 1120 or so it looks bullish technically speaking but a close under 1090 and its a clear sell signal.

Overall this week I am feeling very mixed on the indices as some are looking toppy and some are still showing some resiliency. I do think we should see a sharp move with conviction by the end of this week and that move should guide us for the next few weeks on a directional bias. I am leaning lower as long as we cannot clear the 1120s on the SPX.

Buy the dips>> RIMM, BIDU, EK, EOG, EAT, INCY

Sell the rips>> FCX, GOOG, HES, PDE, GS

Subscribe to:

Posts (Atom)